Corruption Prevention Initiatives/Compliance

Corruption Prevention Initiatives/Compliance

Casio Business Conduct Guidelines

Casio Business Conduct Guidelines Casio has established the Casio Business Conduct Guidelines, a code of conduct to ensure that all executives and employees comply with laws and regulations and act ethically. Casio works to promote thorough awareness and adherence to the Guidelines and strives to foster an integrity-driven culture.

Contents of the Casio Business Conduct Guidelines

1. Developing high-quality products and services and continuing to serve society

2. Careful environmental considerations in all business activities

3. Ensuring fair, honest, and appropriate transaction activities

4. Respecting human rights in all aspects of business activities

5. Respecting employee diversity and fostering supportive work environments

6. Appropriate disclosure of corporate information and constructive stakeholder dialogue

7. Promoting social contribution activities to help realize a sound and spiritually rich society

8. Performing comprehensive risk management of any hazards such as natural disasters, information security breaches, and sudden changes in the business environment

9. Senior management and heads of organizations’ responsibility for setting a good example of leadership by fully observing the Casio Business Conduct Guidelines and ensuring they are completely known to everyone

Compliance System

Casio recognizes that compliance is the foundation for all corporate activities. Accordingly, Casio believes it is important to win the trust of society by ensuring all of its corporate activities are based not only on legal compliance, but also on high ethical values. To ensure legal compliance, Casio’s Internal Control Committee inventories laws and regulations related to the conduct of business and confirms that the responsible departments take appropriate measures to comply. The Casio Business Conduct Guidelines are also made known to all executives and employees.

In addition, Casio set up the Compliance Office in the Legal Department to serve as an organization responsible for the overall management of compliance. The Compliance Office is working to ensure even more thorough compliance with laws and regulations in the conduct of business, reform systems, and reinforce the administration of education and internal rules.

Fair Competition

Fair and free competition in both the Japanese and other markets requires an environment that allows competitive business activities to be conducted autonomously, and this environment depends upon compliance with antitrust laws by individual companies. After reflecting on the antitrust law violation for which Casio was penalized by the U.K. Competition and Markets Authority (CMA) in 2019, Casio established the Antitrust Compliance Program as a measure to prevent recurrence, promote fair marketing activities that comply with laws and regulations, and provide products and services trusted by customers. We have continued to implement activities to increase awareness of rules related to antitrust law and ensure compliance.

We have distributed the Compliance Manual to all sites outside Japan to ensure awareness. We also provide employee education at each site and conduct audits of compliance with antitrust law. We are working to further consolidate the program by considering and implementing countermeasures for problems revealed by audit results.

In Japan, we have established a dedicated committee organized by the relevant departments to ensure compliance with Japan’s Act against Unjustifiable Premiums and Misleading Representations and Act against Delay in Payment of Subcontract Proceeds, Etc., to Subcontractors (Subcontract Act), and we are responding to legal revisions and implementing awareness promotion activities, including development of self-management regulations and education. Moreover, we are striving to provide proper product descriptions by making efforts including having the committee secretariat provide guidance, responding to customer and business partner opinions and feedback, implementing self-audits in relevant departments, and sharing case studies of improvements.

Executives and employees at all sites worldwide participate in group-wide education, which is primarily e-learning, and all programs maintain a high participation rate.

Protecting Personal Information

As laws and regulations concerning personal information become more stringent globally, in order to promote business using data worldwide, we must adhere to the privacy laws of each country. To this end, in March 2021, we established the Office for Personal Data Protection outside Japan, a dedicated office for addressing global privacy laws. The office works to strengthen compliance structure by tracking legal trends of each country, ensuring the appropriate handling of personal information—from acquiring to storage, usage, and disposal—and conducting employee education and regular audits.

In the conduct of business, Casio’s Internal Control Committee inventories relevant laws and regulations and confirms that the responsible departments take appropriate measures to comply. If any deficiencies are found, corrective measures are taken and regular monitoring is conducted.

In 2023 and 2024, there were incidents in which personal information was leaked within the Casio Group. Going forward, we will further strengthen management controls and employee training to prevent a recurrence of such incidents.

Export Control

Export control, or security trade control, aims to maintain international peace and security. It involves regulations on the export of goods and technology that could be diverted for the development of weapons of mass destruction or other weaponry. The regulations are designed to prevent such goods and technology from reaching countries and regions of concern or terrorist organizations.

In 1987, the Export Control Security Program of Casio Computer Co., Ltd. (a compliance program) was established in order to make sure proper measures are taken to ensure the security of exports. The program has since been continually updated along with changes in the Japanese Export Control Regulation.

Casio has appointed employees responsible for export control in relevant departments as part of an internal system to ensure observance of the program.

As the Exporter Compliance Standards took effect in April 2010, Casio has been striving to maintain and manage its system by conducting voluntary annual audits while ensuring thorough legal compliance, in response to the revision of applicable laws and regulations. Efforts include the strengthening of training activities at group companies in Japan.

Casio has also established a management system for complying not only with Japanese export laws but also with US Export Administration Regulations. The company is working to improve global export management, including the implementation of export management training in fiscal 2013, at group companies in the UK and Germany, and in fiscal 2014 at a group company in the US.

In fiscal 2024, we disseminated information on revisions to laws and regulations related to the situation in Ukraine, and we also brought in external instructors to conduct online training for 100 people, including executives and other people in charge of export control organizations. This training was intended to deepen understanding of Japan’s Foreign Exchange and Foreign Trade Act and when it applies, as well as recent conditions around the world.

In fiscal 2025, we strengthened our response to stricter export regulations in various countries, mainly related to economic sanctions against Russia. We also implemented in-house education to promote understanding of regulations and other measures in light of the global situation and to prevent evasive action such as indirect exports.

Initiatives Related to Appropriate Transactions with Business Partners

Casio has established a Compliance Committee on the Subcontract Act which includes group companies, and is striving to ensure all transactions comply with the law including the Subcontract Act and other laws related to subcontractor protection. Under the annual basic plan of the Committee, each group company in Japan implements PDCA cycles. In fiscal 2021, in-house seminar subjects were expanded and made available to all employees.

In our in-house training, we set scenarios reflecting actual regulated transaction situations and tailor the content closely to day-to-day operations to deepen understanding. Some Group companies also develop their own materials suited to their specific transaction practices and conduct training to further promote understanding.

In addition, the Compliance Committee is establishing the company’s systems and working to achieve fair and appropriate transactions with business partners in accordance with Japan’s Act on Ensuring Proper Transactions Involving Specified Entrusted Business Operators (Freelance Act), which came into force in November 2024.

Meanwhile, we conduct regular self-audits at least once a year at sites involved in transactions with outsourcers that are subject to regulations. Casio confirms that proper, compliant transactions are executed, by inspecting documents recording the entire series of transactions from ordering to payment.

Casio continues to promote understanding of the Subcontract Act and laws related to fair trading among its employees, and work to strengthen its system for even better compliance. The company will strive to promote even sounder transactions and create value with business partners.

In addition, Casio has announced the “Partnership-Building Declaration,” making clear its approach to co-prosperity among large enterprises and SMEs.

Corruption Prevention Initiatives

The Casio Group takes strict measures to eliminate all forms of bribery—including the provision of illegal or inappropriate benefits such as money or gifts—in all countries and regions, and to prevent corruption. In conducting Group wide business activities, Casio complies with applicable domestic and international anti bribery laws and regulations and, as part of our anti corruption initiatives, has established the Casio Guidance on the Prohibition of Bribery and an internal Anti Bribery Manual.

The Casio Guidance on the Prohibition of Bribery articulates the Group’s basic approach to prohibiting bribery, including a ban on facilitation payments, and specifies governance structures and procedures for anti bribery, as well as specific rules such as monetary thresholds for gifts and hospitality. Additionally, overseas sites are encouraged to develop local rules and manuals that reflect local laws and regulations, in order to strengthen the Group wide anti bribery framework. We will continue to implement measures in line with globalization and changing circumstances, focusing on countries with a high risk of corruption, high risk transaction types, business partners, and payment terms.

Tax Affairs

The Casio Group has established the Casio Business Conduct Guidelines to ensure that all executives and employees act appropriately from the perspectives of legal compliance and ethics, and we promote thorough awareness and adherence to the Guidelines.

This also applies to tax affairs. The Group strives to maintain its tax compliance by paying taxes appropriately in compliance with each country’s tax laws, including transfer pricing taxation and anti-tax haven measures, as well as international rules and other statutes. The Group does not engage in tax planning for the sole purpose of avoiding tax without any business rationale or actual business substance. Moreover, we do not use tax havens for the purpose of intentional tax avoidance.

Important tax issues and risks are reported to the president and the Management Meeting in a timely manner, and we implement the appropriate response, and strive to maintain and improve tax compliance.

Political Donations

When making donations to political funding organizations, Casio complies with relevant laws and regulations, such as the Political Funds Control Act, and manages donations appropriately through an appropriate decision-making process based on internal regulations.

Whistleblower Hotline

Casio set up a Whistleblower Hotline in April 2006 to ensure compliance, including respect for human rights, detect potential legal violations and misconduct as early as possible, prevent the escalation of problems, and take early corrective action.

The external contact point for the hotline is available in English and Chinese, enabling reports from employees and others at overseas group companies. Global consultations and reports can also be received online (as well as telephone consultations and reports in English) 24 hours a day, 365 days a year.

In order to further disseminate and firmly establish the system, we regularly review the system and structure, and we have established a dedicated external contact point for receiving reports from business partners. We have also created a whistleblower reporting system that ensures fair treatment and reliability while guaranteeing the confidentiality of the reporter, by assigning staff with specialized knowledge of whistleblower reporting systems and utilizing external lawyers.

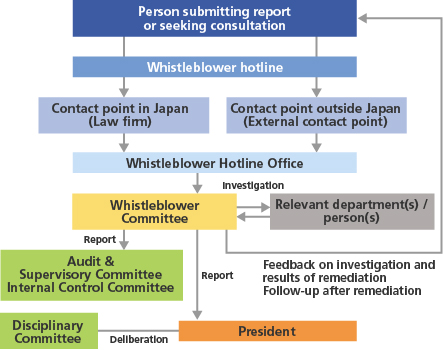

In recent years, there has been growing demand for more effective whistleblower reporting systems due to the revision of Japan’s Whistleblower Protection Act in June 2020. Accordingly, we decided to establish a permanent Whistleblower Committee to ensure independence within the company, as shown in the following organizational chart, and we have revised internal regulations to clearly prohibit any disadvantageous treatment or retaliatory acts against reporters and to clarify confidentiality obligations. Moreover, we reviewed the system in conjunction with the further revision of Japan’s Whistleblower Protection Act in June 2025, and we are working on improvements to make it easier for reporters to use. We have also established a system that ensures fair treatment and reliability from the standpoint of neutrality through the participation of the officer responsible for governance and the officer responsible for human resources in the Whistleblower Committee.

Whistleblower Hotline

*Updated on January 7, 2026