Corporate Governance

Corporate Governance

Corporate Governance System

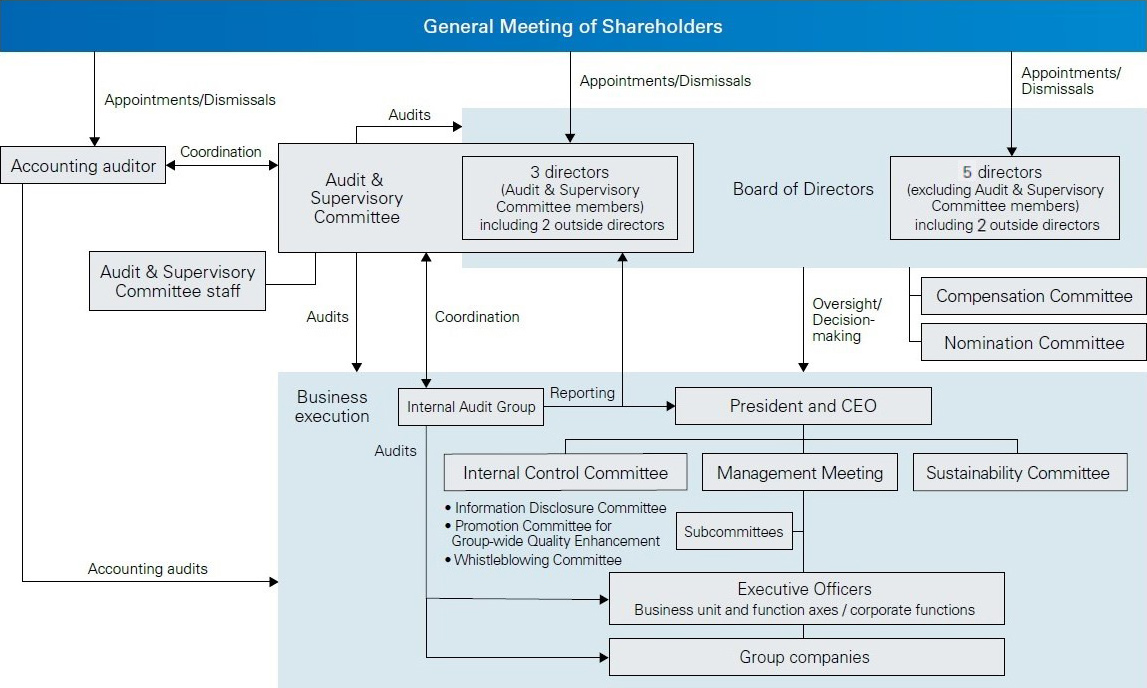

To promote sustainable growth and medium- to long-term improvements to our corporate value, we position swift decision-making, the proper performance of duties, and strengthening our management oversight functions as core issues for the Company. To ensure appropriate responses to these issues, we are strengthening the Board of Directors’ oversight functions. To accelerate and optimize business execution based on appropriate supervision by the Board of Directors, with a resolution passed on June 27, 2019 at the General Meeting of Shareholders, we switched to a company with an Audit & Supervisory Committee structure. Currently, the Board of Directors has eight members, with at least half of the seats reserved for outside directors to strengthen its oversight function.

Board of Directors

The Board of Directors is chaired by the chairman of the Board and consists of the eight members listed in the table below. In addition, to further ensure the diversity of the Board of Directors, the 69th Ordinary General Meeting of Shareholders held on June 27, 2025, resolved to increase the number of women serving as outside directors by one. As a measure to strengthen the oversight function, at least half of the seats on the Board of Directors (four of the eight seats) are reserved for outside directors.

- Five directors (excluding directors who are Audit & Supervisory Committee members [of whom, two are outside directors])

- Three directors serving as Audit & Supervisory Committee members (of whom, two are outside directors)

The term for directors (excluding directors serving as Audit & Supervisory Committee members) shall be one year in order to clarify management responsibilities and enable them to respond to rapid changes in operating environments.

The Board of Directors is responsible for the function of decision-making and overseeing business execution by management. The Board discusses and makes decisions on important management matters specified in laws and regulations, the Articles of Incorporation, and the Rules on the Board of Directors. To increase efficiency and agility in the execution of business, the Board of Directors delegates executive authority to executive officers on matters that do not meet the standards set for referral to the Board of Directors in laws and regulations, the Articles of Incorporation, and the Rules on the Board of Directors.

In the fiscal year ended March 31, 2025, the Board of Directors met a total of 13 times. The subjects of its discussions and deliberations included reports on the state of business and the progress of business performance, as well as matters requiring regular resolution such as the approval of the financial accounts and the convocation of the General Meeting of Shareholders, and important matters relating to business management and management policy considered with reference to the results of the evaluation of the effectiveness of the Board of Directors. These included structural reform to strengthen the profit base, investment for business growth, and internal control issues in the Group.

Audit & Supervisory Committee

The Audit & Supervisory Committee is comprised of three directors who are Audit & Supervisory Committee members. The chair of the Audit & Supervisory Committee is selected by the committee members from among those members who are outside directors. The current chair is ABE Hirotomo.

In order to ensure the soundness and transparency of business management, Audit & Supervisory Committee members attend meetings of the Board of Directors and a range of other important deliberative bodies and committees, where they voice their opinions, as necessary, to ensure appropriate decision-making.

Audit & Supervisory Committee members also exercise strict oversight by meeting regularly to communicate with the representative directors, soliciting information and reports from directors (excluding directors who are Audit & Supervisory Committee members) and others, and reading the documentation for resolutions on important matters.

Nomination and Compensation Committees

When requested by the Board of Directors, the Nomination Committee, after due deliberation, submits proposals to the General Meeting of Shareholders concerning the nomination and removal of directors and recommendations on selection standards for director candidates. When requested by the Board of Directors, the Compensation Committee deliberates on and submits proposals to the Board of Directors concerning the agenda for the General Meeting of Shareholders such as compensation for directors and recommendations on such matters as policies related to the director compensation system and its framework.

Executive Officer System and Executive Officers

Executive officers are delegated certain authority to execute business according to the policies established by and under the supervision of the Board of Directors.

Effective July 1, 2025, the Company reviewed its organizational structure in order to accelerate decision-making and facilitate flexible management decisions. Under this structure, the executive officers consist of the persons responsible for business divisions and key functional divisions in order to ensure specialized expertise is reflected in management and strengthen the governance function, thereby ensuring optimal decision-making from a company-wide perspective. At the same time, the Company is promoting enhancement of development capabilities, flexibility, and strategy execution capabilities based on the responsibility and authority of business division general managers by significantly reducing the number of executive officers and introducing a division-based system into the development structure.

Under this structure, a weekly Management Meeting is held that brings together the executive officers in charge of important functions and duties to discuss important matters, share information, and expedite the execution of business. Executive officers are nominated by the Board of Directors based on competence and performance history from among elite human resources capable of contributing to the further growth of consolidated operations. The term of office is one year, the same as for directors (other than directors who are Audit & Supervisory Committee members).

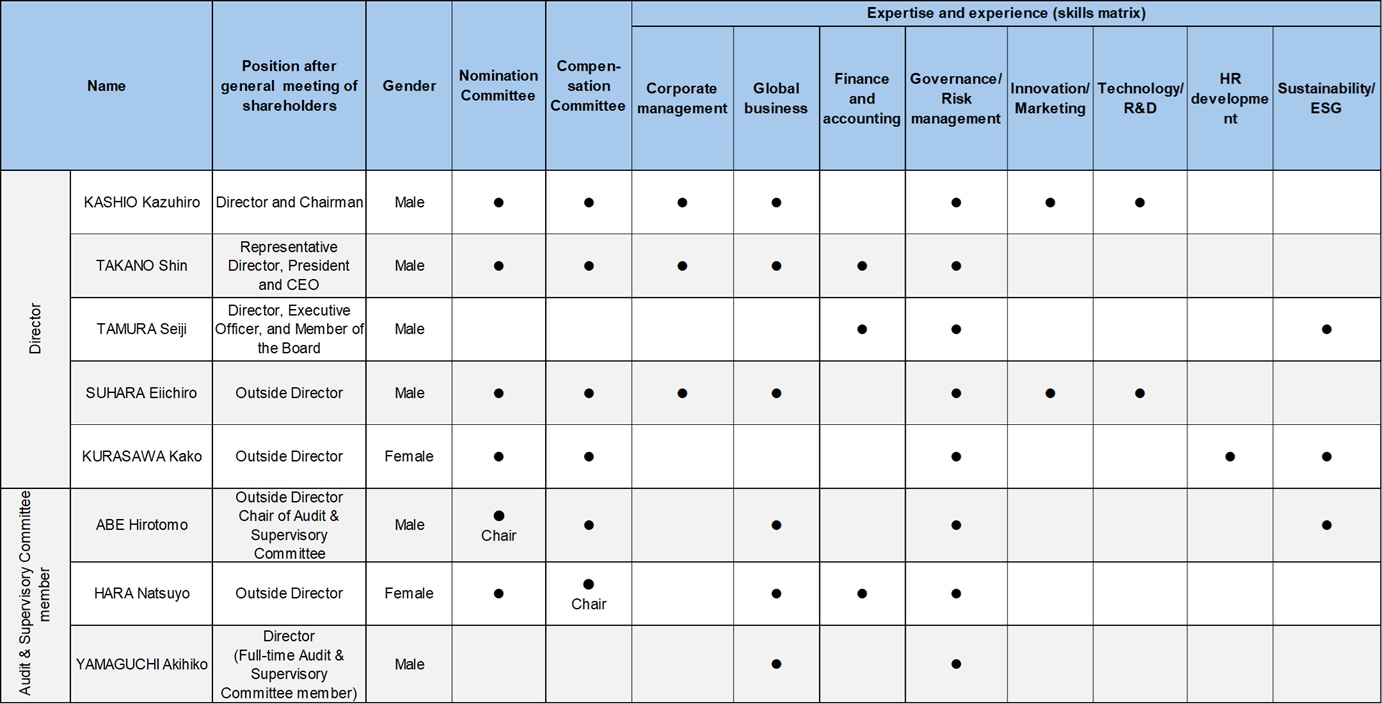

Composition of the Board of Directors

We believe that it is necessary for the Board of Directors to be comprised of members with diverse perspectives, experience, and skills in order to ensure the board’s effective management and oversight functions. As such, in addition to inside directors who are familiar with the Company’s business, our Board of Directors is comprised of outside directors possessing broad knowledge and extensive experience in corporate management, science, administration, finance and accounting, law, and other fields.

Outside directors bring in external perspectives and increase management transparency. The Company also appoints outside directors to further strengthen the oversight function regarding the execution of business. They are experts who can provide opinions and advice from a wide variety of perspectives, including that of stakeholders, and are invited to Board of Directors’ meetings and other meetings.

For the selection of director candidates, a skills matrix has been prepared presenting an overview of the knowledge, experience, abilities, and other attributes expected of directors (please see “Composition of the Board of Directors”). In addition to the expertise and experience indicated in the matrix, the selection of director candidates aims to achieve a balance in terms of diversity, affiliations (independence), years of service, and other attributes. With additional consideration given to changes in the business environment and other factors, the aim is to achieve a Board of Directors in which composition will promote the strengthening of corporate governance and corporate value increase.

The Company engages in ongoing review of the optimal composition of the Board of Directors.

Composition of the Board of Directors

Note: The above table is not an exhaustive listing of the directors’ expertise and experience.

Number of years in office

KASHIO Kazuhiro, Chairman: 14 years/ TAKANO Shin, President: 10 years/ TAMURA Seiji, Director: Appointed in June 2025/ SUHARA Eiichiro, Outside Director: 2 years/ KURASAWA Kako, Outside Director: Appointed in June 2025/ ABE Hirotomo, Outside Director: 6 years/HARA Natsuyo, Outside Director: Appointed in June 2025/ YAMAGUCHI Akihiko, Director: 4 years

Directors’ Training

Based on the belief that directors must continue to advance their skills and knowledge if they are to sufficiently fulfill their roles, we actively promote self-improvement by directors. The Company continuously offers the support, including the provision of information, opportunities, and cost reimbursements, necessary for self-improvement.

We continuously offer information to promote a better understanding of our business operations, particularly for outside directors. This includes planning and providing opportunities, both at the time of appointment and throughout the term of their appointment, to participate in important internal meetings, tour domestic and overseas plants and offices, and attend internal research seminars. Directors who are members of the Audit & Supervisory Committee are provided opportunities for skills improvement necessary for their roles and responsibilities through information provision by the Japan Audit & Supervisory Board Members Association and participation in seminars.

Outside Directors

Outside directors are appointed in order to enhance corporate transparency by incorporating external perspectives into management and further strengthening oversight of operations. The Company appoints experts who are able to provide opinions and advice from stakeholder and other diverse perspectives to the Board of Directors meetings and other meetings.

Reason for Appointment as an Outside Director

| SUHARA Eiichiro |

Independent Director | Mr. SUHARA was active for many years at Mitsubishi Pencil Co., Ltd., where he displayed outstanding skill in business management and played an important role in the company’s sustainable growth and corporate value increase. He has contributed greatly to invigorating the discussions of the Board of Directors and improving its effectiveness by making highly valuable and timely comments and proposals on the management of the Company in general from an objective and varied perspective based on his extensive experience and deep knowledge. He was appointed additionally for his contribution as a member of the Nomination Committee and the Compensation Committee to discussions on improving the transparency and effectiveness of the director appointment process and to discussions looking into the process for determining director compensation. |

| KURASAWA Kako | Independent Director | Ms. KURASAWA was involved for many years in work related to sustainability at Komatsu Ltd., the Foundation for Advanced Studies on International Development, and Tokio Marine Holdings, Inc. and played an important role in the sustainable growth and corporate value increase of those organizations. She has been appointed with the expectation that she will contribute to invigorating the discussions of the Board of Directors and improving its effectiveness from an objective and varied perspective based on her extensive experience and deep knowledge. She was appointed additionally with the expectation that she will contribute as a member of the Nomination Committee and Compensation Committee to discussions on improving the transparency and effectiveness of the director appointment process and to discussions looking into the process for determining director compensation. |

| ABE Hirotomo | Independent Director | Mr. ABE possesses extensive experience of working overseas for a general trading company and specialist knowledge based on his research and other activities as a graduate school student and professor in the fields of law and business management. He has contributed greatly to invigorating the discussions of the Board of Directors and improving its effectiveness by commenting actively on the management of the Company in general from these specialist perspectives. He was appointed additionally for his contribution as the chair of the Nomination Committee and as a member of the Compensation Committee to discussions on improving the transparency and effectiveness of the director appointment process and to discussions looking into the process for determining director compensation. |

| HARA Natsuyo | Independent Director | As a certified public accountant, Ms. HARA possesses professional expertise related to finance and accounting and extensive auditing experience. She has contributed greatly to invigorating the discussions of the Board of Directors and improving its effectiveness by commenting actively on the management of the Company in general from these specialist perspectives. She was appointed additionally with the expectation that she will contribute as a member of the Nomination Committee and the chair of the Compensation Committee to discussions on improving the transparency and effectiveness of the director appointment process and to discussions looking into the process for determining director compensation. |

Diagram of corporate governance system

Internal Auditing

The Internal Audit Group, which consists of seven members (including one who is a member of the Audit & Supervisory Committee staff formulates an annual audit plan (reviewed every six months) in light of the risk situation and, in accordance with the plan, audits the status of organizational management based on common Group standards. The Internal Audit Group then reports the results to the president, directors, and Board of Directors as appropriate to maintain and strengthen the internal control and risk management system. Meanwhile, the Internal Audit Group exchanges information and opinions with the Audit & Supervisory Committee on a regular basis and holds monthly meetings with it. Moreover, when planning internal audits and after conducting them, the Internal Audit Group submits a report on the audit items to the Audit & Supervisory Committee, and the two work together in this way to improve the efficiency and effectiveness of the audit function.

Analysis and Evaluation of Board of Directors’ Effectiveness

With an awareness of the changes in the roles expected of the Board of Directors, we evaluate the effectiveness of the Board of Directors and conduct reviews aimed at strengthening organizational and operational governance.

In the fiscal year ended March 31, 2025, as in the previous fiscal year, we conducted a survey of the directors (including Audit & Supervisory Committee members) to identify potential improvements to the role, functions, operational management, and other aspects of the Board of Directors.

This resulted in the finding that the Board of Directors fulfills its oversight functions. Elsewhere, opinions were expressed on the need to ensure prompt and sound decision-making can be carried out while fundamental issues are discussed in depth. Additionally, opinions were expressed on further enhancing deliberations at the Management Meeting in order to further promote the oversight function of the Board of Directors, and the need to invigorate discussions of the structure for the following fiscal year and discussions based on a medium- to long-term perspective at the Nomination Committee, which is an advisory body for the Board of Directors. Based on the results of this evaluation, we will work to further increase the effectiveness of the Board and make continuous improvements.

Director Compensation

The compensation of executives of the Company is as stipulated below.

Performance-Linked Compensation

Performance-linked compensation in the form of bonuses is decided based on an evaluation of the results of management efforts to strengthen initiatives aimed at improving corporate performance, increasing corporate value and shareholder value, and achieving sustainable growth for society. Specifically, the decision is made with reference to the degree of attainment of financial targets (based on the indicators of operating profit, net sales, and ROE as shown in the consolidated financial accounts) and nonfinancial targets (sustainability indicators), as well as after comparing each indicator with the previous fiscal year’s performance and evaluating relative TSR.

Breakdown of non-monetary Compensation

We have introduced a system of non-monetary compensation in the form of restricted stock compensation. The aim is not only to provide an incentive toward continuous increase in corporate value, but also to further reinforce the sense of value sharing with shareholders. The number of shares allocated to each individual is calculated by dividing a figure representing a fixed proportion of the individual’s total annual compensation by the stock price.* A restriction on stock transfer applies until the director’s retirement.

* Closing price on the day before the Board of Directors meeting at which allocation is approved.

Resolutions of the General Meeting of Shareholders on Director Compensation

A resolution was passed at the 68th Ordinary General Meeting of Shareholders held on June 27, 2024, setting the maximum combined annual compensation amount at a total of 400 million yen for directors (excluding directors who are Audit & Supervisory Committee members but including a maximum annual amount of 50 million yen for outside directors). This compensation does not include employee salaries paid to directors with concurrent employee duties. The number of directors as of the close of the above General

Meeting of Shareholders (excluding directors who were Audit & Supervisory Committee members) was eight (including three outside directors).

The total annual compensation for directors who are Audit & Supervisory Committee members was set at a maximum of 70 million yen by resolution of the 63rd Ordinary General Meeting of Shareholders held on June 27, 2019. As of the close of the above General Meeting of Shareholders, the number of directors who were Audit & Supervisory Committee members was three.

Meanwhile, a resolution of the 63rd Ordinary General Meeting of Shareholders held on June 27, 2019, set the maximum annual amount of restricted stock compensation for directors (excluding Audit & Supervisory Committee members and outside directors) at 100 million yen (maximum 80,000 common shares) and within the limits on director compensation specified above. As of the close of the above General Meeting of Shareholders, the number of applicable directors was four.

Agreed Policy on the Content of the Individual Directors’ Compensation

(1) Method of deciding agreed policy on the content of the individual directors’ compensation

To set the agreed policy on the content of the individual directors’ compensation, the Board of Directors advised the Compensation Committee on the formulation of draft proposals, and adopted an agreed policy with acceptance of the content of the submitted proposals.

(2) Outline content of the agreed policy

The two points indicated below form the basic policy on the compensation of directors (excluding directors who are Audit & Supervisory Committee members; the same applies below), which is designed to function as a healthy incentive toward sustainable growth.

- Compensation is set at a competitive level with a view to attracting external human resources

- Compensation is designed to serve as an incentive promoting a healthy entrepreneurial spirit

The level of compensation is set according to the role expected of the position, with market benchmarking for reference.

The compensation of directors other than outside directors is composed of a fixed component supplemented by a performance-linked component made up of bonuses and stock compensation. In view of their particular duties, the compensation of outside directors consists of fixed compensation only.

To give greater emphasis to performance-linked compensation, the relative weights of the compensation components are set at 40% for fixed compensation and 60% for performance-linked compensation for the President & CEO and 50% for fixed compensation and 50% for performance-linked compensation for directors. (Performance-linked compensation is made up of 45% in bonuses (consisting in turn of 35% linked to financial and non-financial targets and 10% linked to TSR) and 15% in stock compensation for representative directors and 35% in bonuses (consisting in turn of 25% linked to financial and non-financial targets and 10% linked to TSR) and 15% in stock compensation for other directors. However, these proportions may be adjusted according to the individual role.

Delegation of Responsibility for Decision on Individual Directors’ Compensation

The Compensation Committee, chaired by an outside director, discusses aspects of director compensation such as the compensation system and compensation level in response to a request from the Board of Directors, to which it then submits proposals. Based on these proposals, the Board of Directors delegates to the chairman of the Board and the president and CEO the responsibility for deciding the individual compensation in accordance with the compensation limits adopted by the General Meeting of Shareholders and the agreed policy on compensation. The chairman of the Board and the president and CEO confer with the directors who are Compensation Committee members before deciding on individual compensation based on the proposals submitted by the committee and with reference to performance in terms of both oversight of business management and business execution. The reason for the delegation of the decision on individual compensation to the chairman of the Board and the president and CEO is that these officers are considered the most appropriate to evaluate the department that the director is in charge of based on an overview of the Company’s performance, etc.

Compensation for FYE 3/2025

| Executive category | Total compensation amount | Total amount by compensation type | Number of applicable executives | |

|---|---|---|---|---|

| Directors (Excluding Audit & Supervisory Committee members and outside directors) |

217 million yen |

Fixed compensation | 126 million yen | 5 |

| Performance-linked compensation | 91 million yen | |||

| Non-monetary compensation included in the above figure | 43 million yen | |||

| Audit & Supervisory Committee members (Excluding outside directors) |

15 million yen | Fixed compensation | 15 million yen | 1 |

| Outside directors | 54 million yen | Fixed compensation | 54 million yen | 5 |

Note: Amounts paid to directors do not include employee salaries paid to directors with concurrent employee duties.

Dialogues with Shareholders

We recognize that it is crucial to build a long-term, trust-based relationship with our shareholders and investors through proactive dialogue, so we have a dedicated executive officer responsible for investor relations (IR) activities under the direction of our president and CEO.

Our internal structure promotes a common awareness of the importance of dialogue with shareholders. We

collaborate on IR activities by gathering and accumulating necessary information from the networks linking relevant departments. Directors or executive officers directly engage in IR activities as necessary depending on theme and content. In addition to sharing opinions received through shareholder interactions with the Board of Directors, we also share information at the Management Meeting and on other occasions as necessary to reflect those opinions in measures aimed at improving corporate value.

To ensure the management of insider information during IR activities, we have outlined rules concerning the

handling of important undisclosed information and work to ensure strict implementation of those rules. Part of our response measures includes requiring that meetings are attended by multiple people.

In addition to communication through individual meetings, other measures for IR management include holding quarterly earnings briefings for institutional investors and securities analysts where the president and CEO or executive officer responsible for IR provides a summary of financial results and future outlook. To promote further understanding of our Company, we are enhancing external communications by listing various IR information on our website and have established a help desk for receiving inquiries from shareholders.

Basic Views on Internal Control System and Progress on System Development

The Casio Group has established the Charter of Creativity for Casio, Casio Common Commitment and Casio Business Conduct Guidelines based on the corporate creed of “Creativity and Contribution.” The following systems have been implemented to ensure proper business operation.

1. System to ensure that performance of duties by directors and employees of the Company and group companies comply with the Articles of Incorporation and relevant laws and regulations

a. Based on laws, the Articles of Incorporation, and rules for the Board of Directors, the Board of Directors decides important issues relating to legal requirements and management of the Company and group companies, and prevents violations of the law or the Articles of Incorporation by monitoring the performance of duties by the directors.

b. In order to comply with relevant laws and regulations regarding the performance of duties, specific documents such as policies and rules are prepared. Awareness of these is promoted throughout the Company and each Group Company after various committees, such as the Internal Control Committee, have examined and deliberated on them.

c. The Whistleblower Hotline has been established with internal and external channels and operates as the point of contact for inquiries and reporting on problems related to legal violations and other compliance matters. The Company ensures that whistleblowers are not penalized.

d. The Company and Group companies are not involved with antisocial forces, which pose a threat to social order and public safety, in any way, and the entire organization is resolute in refusing any improper demands.

e. The validity and operational adequacy of the above-mentioned rules are improved through internal audits and continual review, in order to prevent any misconduct.

2. System for retaining and managing information relating to performance of duties by directors and employees of the Company and group companies

Each department retains and manages information relating to the performance of duties by the directors and employees concerned, based on the Document Management Rules and other rules.

3. Risk management rules and other systems at the Company and the Group Companies

a. The Company and the Group Companies have a system to manage risks that can have a significant impact on management. The system is promoted in a unified way by the relevant departments and the Secretariat for the Internal Control Committee, based on the Risk Management Rules.

b. Fundamental Policies on Product Safety and an implementation system have been established with an understanding that maintaining customer confidence in product safety is an important management issue.

4. System to ensure the efficient performance of duties by directors and employees of the Company the Group Companies

a. Board of Directors meetings are held to discuss important management issues facing the Company and the Group Companies. Such meetings are held at least once a month, in principle, to enable decisions to be made swiftly and in a reasonable manner.

b. The Company’s executive officers and directors (including Audit & Supervisory Committee members) attend Management Meeting to discuss and decide on the execution of important business matters. They ensure group-wide coordination and smooth implementation of measures.

c. Detailed execution procedures are outlined in the Executive Decision Making Authority Rules and the Group Company Decision Making Authority Rules.

d. The Group Companies have created a system for performance of duties based on consolidated management plans, the Group Company Decision Making Authority Rules, and various basic group policies.

5. System to ensure proper operations at the Company and group companies

a. To ensure proper operations, the Company and the Group Companies have various rules based on the Charter of Creativity for Casio, Casio Common Commitment, and Casio Business Conduct Guidelines.

b. The Company assigns certain directors or executive officers based on a system under which directorsand officers are responsible for specific Group Companies. The relevant directors and executive officers perform the Group Company management through a system that requires reporting to and approval by the Company, in accordance with the Group Company Decision Making Authority Rules. They also perform monitoring as necessary.

c. The Company and the Group Companies have built a system to ensure the adequacy and reliability of financial reporting. After internal controls related to business flow and financial reporting are inspected, they are documented and evaluated, and revised to improve them.

6. System for employees that assist Audit & Supervisory Committee in the performance of their duties, and the independence of those employees from the directors (who are Audit & Supervisory Committee Members)

a. Employees are appointed to assist Audit & Supervisory Committee in their duties.

b. Matters concerning the appointment, transfer, evaluation or discipline of employees who assist the Audit & Supervisory Committee require prior consent from the Audit & Supervisory Committee.

7. System for the Company’s directors and employees and group companies’ directors, auditors, and employees to report to the Audit & Supervisory Committee; other systems for reporting to the Audit & Supervisory Committee; and systems to ensure that audits by the Audit & Supervisory Committee are performed effectively

a. Whenever something that is likely to cause significant damage to the Company or the Group Companies, facts pertaining violation of the law or the Articles of Incorporation, or facts pertaining to illegal conduct of business are discovered, the Company’s directors and employees must immediately report these to the Audit & Supervisory Committee.

b. Whenever something that likely to cause significant damage to the Company or the Group Companies, facts pertaining to a violation of the law or the Articles of Incorporation, or facts pertaining to illegal conduct of business are discovered, the directors, auditors and employees of a Group Company must immediately report it to the Company officer in charge of the Group Company, and that officer must immediately report it to the Audit & Supervisory Committee.

c. Whenever a Group Company’s directors, auditors and employees determine that a management action or guidance from the Company may violate the law, or may present a compliance issue, they must report it to the Audit & Supervisory Committee.

d. The Company’s directors and employees and the directors, auditors and employees of the Group Companies will submit reports and information in response to requests from the Audit & Supervisory Committee.

e. The Company’s Internal Audit Department periodically reports the results of audits of the Company and the Group Companies to the Audit & Supervisory Committee.

f. The Whistleblower Hotline Secretariat reports the status of whistleblower reports and measures taken to the Audit & Supervisory Committee.

g. The Company and the Group Companies ensure that people who have made a report to the Audit & Supervisory Committee are not penalized.

h. The Company promptly processes any requests it receives for the prepayment or reimbursement of expenses arising from the performance of duties by the Audit & Supervisory Committee.

i. Audit & Supervisory Committee Members may attend any important internal meeting of the Company.

j. Important ringi approval documents of the Company and the Group Companies are reported to the Audit & Supervisory Committee after approval.

*Updated on September 11, 2025